Good Advice For Choosing RSI Divergence Trading

Wiki Article

Let's begin with the most obvious question and find out what RSI Divergence is and what trading clues we can get from it.|Let's start by asking the obvious question. Let's find out the meaning behind what RSI Divergence means and what trading clues it can provide.|Let's begin with the obvious question. We will explore what RSI Divergence actually is and what insights traders can get from it.|Okay, let's begin by asking the obvious question. We'll look into what RSI Divergence really is and what trading signals we could take away from it.|Let's start with the most obvious question. Let's look at what RSI Divergence looks like and the trading signals that can be drawn from it.} A divergence occurs when the price action is not in accordance with the RSI indicator. Which mean, in a Downtrend market price makes a lower low. However, the RSI indicator has higher lows. Divergence occurs when the indicator is not in agreement with the price action. When this happens, it is important to watch the market. Based on the chart, both bullish RSI divergence and the bearish RSI divergence are clearly visible and the price action has actually reversed in the wake of both RSI divergence signals. Is that right? Let's move on to the fun discussion. Take a look at recommended forex tester for site recommendations including cryptocurrency trading bot, best forex trading platform, backtesting tool, trading platform, cryptocurrency trading, divergence trading forex, trading with divergence, backtesting platform, RSI divergence cheat sheet, RSI divergence cheat sheet and more.

How Do You Assess The Rsi Divergence?

We are using the RSI indicator to identify trend reversals. To do this, it's essential first to establish a trending market. Then, we utilize RSI diversification to find weaknesses in the current trend. Finally, we can use that information for the appropriate time to record the trend reversal.

How Do You Spot Rsi Divergence When Trading Forex

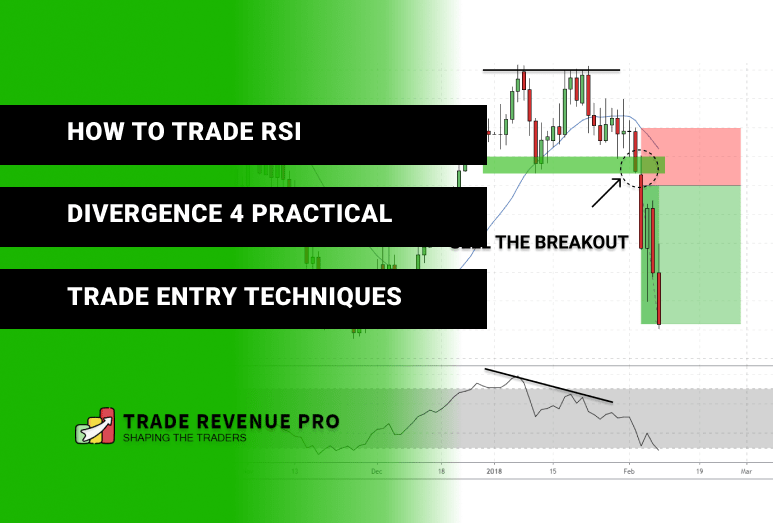

At the beginning of the trend, both RSI indicator and Price Action performed the same process by making higher highs. This indicates that the trend may be extremely strong. The trend ended with Price hitting higher levels at the conclusion. However, the RSI indicator reached lower levels. This means the chart is worth watching. This is why that we must pay close focus on the market. The indicator as well as the price action are out-of-synchrony and this suggests an RSI divergence. The RSI divergence in this case signifies a bearish trend change. Take a look at the chart above and notice what happened after the RSI divergence. It is evident that the RSI divigence is extremely accurate in identifying trends that reverse. The question ishow do you spot the signs of a trend reversal? Let's discuss four trade entry strategies that provide higher probability entry signals when combined with RSI divergence. See the top backtesting for more info including stop loss, forex tester, online trading platform, best forex trading platform, best forex trading platform, bot for crypto trading, crypto trading backtester, best trading platform, crypto trading bot, RSI divergence and more.

Tip #1 – Combining RSI Divergence & Triangle Pattern

Triangle chart pattern is used in two different ways. One variation is the pattern known as the Ascending Triangle. It can be used as a reversal design during an downtrend. The second variation is the descending triangular design, that is utilized in markets that are in an uptrend to act as an opportunity to reverse. Below is the descending triangle pattern. Similar to the previous example, the market was still in an uptrend but eventually the price began to slow down. RSI could also signify divergence. These clues point out the weakness of this uptrend. We can see that the trend is slowing down. The price formed an descending triangle as a result. This confirms that the trend is turning. Now is the time to complete the trade. This trade was executed by using the same breakout method as the previous one. Now let's move into the third method of trading entry. This time we are going to match trend structure and RSI divergence. Let's look at how to trade RSI divergence when the structure of the trend is changing. Check out the top rated trading platforms for site tips including best crypto trading platform, crypto backtesting, forex backtesting, divergence trading forex, forex trading, divergence trading, trading platform cryptocurrency, best forex trading platform, position sizing calculator, best crypto trading platform and more.

Tip #2 – Combining RSI Divergence with the Head and Shoulders Pattern

RSI divergence aids forex traders identify market reversals, isn't it? Combining RSI divergence together with other indicators that indicate reversals, such as the head and shoulders pattern can increase our trade probability. That's fantastic! Let's examine how we can time trades by combining RSI diversification along with the Head and Shoulders pattern. Related - How to Trade Head and Shoulders Patterns in Forex - A Reversal Trading strategy. A stable market is essential before we can think about trading. We're trying to find a trend reverse, so it is best to be in a market that is moving. The chart is below. Follow the best cryptocurrency trading bot for more advice including crypto backtesting, cryptocurrency trading, forex backtest software, backtesting trading strategies, cryptocurrency trading bot, automated trading software, cryptocurrency trading, backtesting trading strategies, cryptocurrency trading, automated trading platform and more.

Tip #3 – Combining RSI Divergence with the Trend Structure

Trends are our friends, isn't it? As long as the market is trending, we need to be trading according to the direction of the trend. This is what experts teach. The trend does not last forever. It will eventually reverse. Let's look at how we can find those reversals in the early by observing trend structure and the RSI Divergence. We all know that the uptrend is making higher highs while the downtrend has lower lows. The chart below illustrates this point. It shows downtrend with series of lower lows and highs. Next, you can see the RSI deviation (Red Line). Price action causes Lows however, the RSI create higher lows, do you think? What can this mean? Despite the fact that market created lows, the RSI does exactly the opposite. This indicates that a downtrend is ongoing and has lost its momentum. It's time to prepare for a potential reversal. See the most popular automated cryptocurrency trading for blog info including backtesting trading strategies, forex tester, crypto trading backtesting, backtesting strategies, crypto trading backtester, trading platforms, crypto trading, automated cryptocurrency trading, forex backtesting software free, automated cryptocurrency trading and more.

Tip #4 – Combining Rsi Divergence, The Double Top Double Bottom, And Double Bottom

Double-bottom or double-top is a reversal chart that forms after a long move or the emergence of a trend. Double tops are formed when the first top will be formed when the price hits an unattainable level that cannot be broken. The price will start to recover after reaching this level but then it will retest the previous levels. If the price bounces off that level again, then you have a DOUBLE TOP. Take a look at the double top that is below. The double top above illustrates that the two tops were formed following a powerful movement. The second top was not able to break above its predecessor. This is a strong sign that buyers are struggling to go higher. The same principle applies to the double bottom, however, it's done in reverse. In this case, we apply the technique of breakout entry. In this scenario we make selling the trade when the price fell below the trigger line. The price reached our profit target in less than a day. QUICK PROFIT. The same trading techniques are applied for the double bottom as well. The graph below illustrates how you can trade RSI Divergence using Double Bottom.

This isn't the most ideal trading strategy. There is no such thing called perfect trading strategy and all the trading strategies have losses and are inevitable. While we earn consistent profit using this strategy, however, we are able to implement a rigorous risk management system and a method to limit the losses. This will decrease our drawdown, which could allow for huge upside potential.