Good Advice For Picking RSI Divergence Trading

Wiki Article

Recommended Suggestions For Choosing An RSI Divergence Strategy

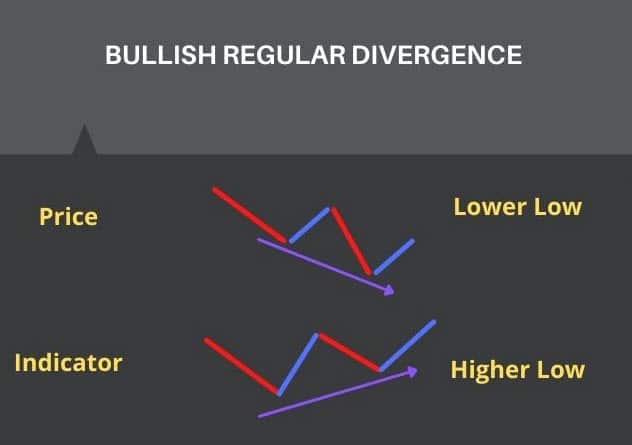

Let's begin with the most obvious query and look into what RSI Divergence is and what trading indicators we can learn from it. If the price action and RSI indicators are not in sync, a Divergence is observed in the chart. In an economy that is in a downtrend price makes a lower low, but the RSI indicator has higher lows. Basically, a divergence form when the indicator does not coincide with price movements and when a situation like this occurs, you need to be attentive to the market. The chart shows that both the bullish RSI diversgence as well as bearish RSI diversion are evident. In fact the price action was reversing after receiving the two RSI Divergence signals. Let's discuss one last topic before move to the thrilling topic. Have a look at the best automated trading software for blog tips including trading platforms, automated trading platform, stop loss, trading with divergence, automated trading bot, automated forex trading, forex backtesting software free, automated trading software, stop loss, best crypto trading platform and more.

How Can You Analyse Rsi Divergence

We're using the RSI indicator to spot trends that are reversing. To do this, it's essential to be in a market that is trending. After that, we employ RSI diversification to find weak points in the current trend. Then, we can make use of that information to determine the best time to identify the trend reverse.

How To Detect Rsi Divergence When Trading Forex

Both Price Action and RSI both hit higher highs during the initial uptrend. This is usually a sign that the trend seems solid. The trend ended with Price hitting higher highs at the end. However, the RSI indicator was able to reach lower highs. This means that this chart is worth watching. This is the reason why to pay at the market. The indicator as well as the price action are not in sync that signifies an RSI divergence. In this case, the RSI diversion signals the bearish trend. Take a look at the chart above and notice what transpired after the RSI divergence. It is evident that the RSI divergence is very precise in identifying trend reversals. However, the issue is: How to actually catch the trend reversal, right? Let's look at 4 practical trade entry methods that can be used in conjunction with RSI Divergence to provide more reliable entry signals. View the best crypto trading backtester for website advice including trading platform cryptocurrency, cryptocurrency trading bot, best crypto trading platform, backtester, forex backtesting software free, trading platforms, forex backtesting software, forex backtester, crypto trading bot, stop loss and more.

Tip #1 – Combining RSI Divergence with the Triangle Pattern

Triangle chart pattern has two variations. One of them is the Ascending triangle pattern which is works as a reversal pattern in a downtrend. Another variant is the descending circle that is reverse patterns in a market that is trending upwards. Check out the pattern of descending triangular as shown on the chart of forex. Like the previous example above, the market was initially in an uptrend before the price fell. RSI may also be a sign of divergence. These indicators reveal the weak points in this uptrend. We know now that the trend is slowing down. The price formed the descending triangle pattern in the process. This is also a confirmation of the reverse. It's time for the short trade. Similar to the previous trade, we used the same breakout strategies to execute this trade. Let's now get to the third entry method. We will combine trend structure and RSI diversification. Let's look at how we can trade RSI diversion when the trend structure changes. Follow the top rated automated trading software for more tips including trading with divergence, divergence trading, backtesting, cryptocurrency trading bot, cryptocurrency trading, trading with divergence, trading platform crypto, forex backtester, forex backtesting software free, automated forex trading and more.

Tip #2 – Combining RSI Diversity and the Head &shoulders Pattern

RSI divergence is a technique forex traders employ to detect market reverses. What happens when we mix RSI divergence and other reversal factors such as the head pattern? This increases our odds of trading. Let's take a examine how we can time trades by combining RSI divergence with the Head and Shoulders pattern. Related: How to Trade Head and Shoulders Forex - A Reversal Trading Strategie. A stable market is necessary before we consider trading. If we wish to see an improvement in trend the best thing to do is have a strong market. Take a look at the chart below. Check out the best forex backtester for website recommendations including trading with divergence, forex backtesting, automated trading software, cryptocurrency trading, online trading platform, forex backtesting software free, cryptocurrency trading, crypto trading backtesting, forex trading, RSI divergence and more.

Tip #3 – Combining RSI Divergence and the Trend Structure

The trend is our best friend. If the market is in a trend, then we should invest in that direction. This is what experts demonstrate to us. The trend will eventually end but it won't last for a long time. So let's see how to detect reversals early time by looking at the structure of the trend and RSI Divergence. We are all aware that the upward trend is creating higher highs while the downtrend is forming lower lows. Check out the chart. It is a downward trend with a series of lower lows and highs. Then, take a look at the RSI divergence that is highlighted in the chart (Red Line). The price action is what creates lows, while the RSI creates lower lows. What is the significance of this? Despite the fact that market created lows however, the RSI is doing the exact opposite. This suggests that a downtrend is ongoing and has lost its momentum. It is time to get ready for a reverse. Have a look at the top rated best forex trading platform for site info including trading with divergence, backtesting, automated trading platform, automated trading bot, best forex trading platform, crypto trading, forex trading, forex backtesting software free, backtester, crypto trading backtester and more.

Tip #4 – Combining Rsi Divergence Along With The Double Top & Double Bottom

A double top (or double bottom) is a type of reversal that occurs after an extended move or trend. The double top forms after the price has reached a level which is impossible to break. When that level is reached, the price will fall slightly, then come back to the previous level. A DOUBLE TOP happens where the price bounces off of that threshold. Take a look below at the double top. The double top you see above shows two tops which resulted from a powerful move. You'll notice that the second one hasn't been able break the top of the first. This is a sign of an inverse. It's telling investors that they struggle to keep climbing higher. The same principles apply to the double bottom, but it is done in reverse. We will apply the method of breakout entry. So, in this case, we execute selling the trade when price has risen below the trigger line. We took our profit once the price had fallen below the trigger line. Quick Profit. Double bottom also requires the same trading techniques. Take a look at this chart to understand how to trade RSI divergence and double bottom.

It's not the best trading strategy. There isn't a perfect trading strategy. All trading strategies have losses which are inevitable. We earn consistence profit through this trading strategy however we're using a tight risk management and a technique to cut our losses quickly. We can cut down on our drawdown while also opening up new opportunities for great upside potential.